Weekly Recap:

Markets were volatile day by day last week as optimism around a debt ceiling deal ebbed and flowed. A strong two-day rally on Wednesday and Thursday eventually ran out of steam as it became clear that a deal was not going to take place before the weekend, leading to a small pullback on Friday. Still, all major US equity benchmarks finished solidly in the green, with growth stocks leading the way and defensive sectors firmly on the back foot.

Renewed appetite for risk assets was clearly reflected in fixed income markets as well. Bond prices fell as rates rose across the curve, and credit spreads tightened.

While not front and center on investors’ minds last week, macroeconomic data continued to paint a picture of a slowing US economy, albeit not universally. Signs of deceleration included:

- Empire Manufacturing sunk back into contraction territory at -31.8

- Philly and New York Fed regional surveys remained in the contraction zone

- Existing home sales, residential building permits, and mortgage applications all fell

- Initial jobless claims (242k) remain elevated relative to recent cycle lows

- The Conference Board’s Leading Economic Index (LEI) fell to a fresh cycle low

On a more positive note:

- Retail sales for April (+0.4% m/m) rebounded after falling in March

- The National Association of Home Builders market index rose to 50 (neutral)

- Industrial Production rose 0.5% in April, while Capacity Utilization increased +30bp

Albion’s “Four Pillars”:

Economy & Earnings

The US economy enjoyed a strong second half of 2022, but growth has slowed in early 2023 and corporate operating margins have been gradually falling as labor and input cost pressures bite. Albion’s base case expectation is that the US economy will enter recession in 2023, putting downside pressure on earnings.

Valuation

The S&P 500’s forward P/E of 18x is above the long run average. More predictive metrics like CAPE, Tobin’s Q, and the Buffett Indicator (Mkt Cap / GDP) suggest that compound annual returns over the next decade are likely to be below the long-run historical average.

Interest Rates

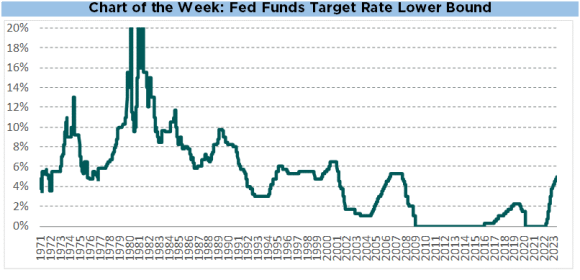

Rates rose in 2022 in response to a sharp pivot in monetary policy, but have been steady to slightly lower across most of the curve so far in 2023. Futures markets are currently pricing a Fed pause after 500bp of hikes over the past 14 months, with the possibility of rate cuts in the back half of the year.

Inflation

After reaching 40yr highs in spring of 2022, inflation has moderated somewhat over the past 12 months. Goods inflation has fallen due to softening demand and excess inventory, while services inflation remains elevated, in part due to shelter costs which are somewhat lagged.