Weekly Recap:

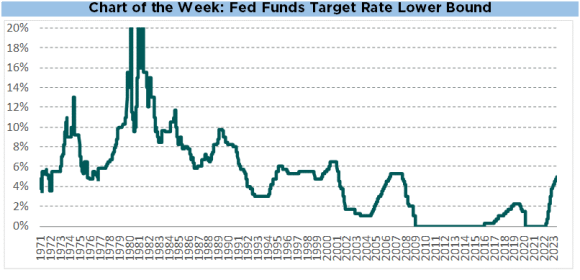

After delivering the widely anticipated 25bp rate hike last week, the Fed has now raised its target overnight interest rate by 500bp across just 10 meetings spanning 14 months. This is the fastest +500bp move since 1980, when Paul Volcker raised rates by more than 1,000 basis points in just 5 months to finally tame runaway 1970s inflation. It is widely anticipated that last week’s 25bp increase marks the end of this hiking cycle, with futures markets pricing in a rate cut as soon as the September meeting.

In fixed income, the Treasury yield curve inversion showed preliminary signs of moderating last week, with the front end rallying while longer term yields rose. Credit spreads widened as lingering concerns regarding the banking sector were exacerbated by the seizure of First Republic and its ensuring sale to JP Morgan over the prior weekend.

Equities were mixed and experienced significant intra-week volatility, with the VIX touching 20 on Thursday for the first time in more than a month. Regional bank stocks came under heavy selling pressure before staging a strong comeback on Friday, but most still finished down for the week. Energy stocks were also weaker on sharply lower oil prices.

The highlight of last week’s macro calendar was the monthly jobs report from the BLS, which came in stronger than expected and fueled a rally in equities. 253k nonfarm payrolls were added, easily beating consensus estimates of 185k, while U-3 unemployment (3.4%) and U-6 underemployment (6.6%) both fell by 10bp.

Albion’s “Four Pillars”:

Economy & Earnings

The US economy enjoyed a strong second half of 2022, but corporate operating margins have been gradually falling as labor and input cost pressures bite. Albion’s base case expectation is that the US economy will enter recession in 2023, putting downside pressure on earnings.

Valuation

The S&P 500’s forward P/E of 18x is above the long run average. More predictive metrics like CAPE, Tobin’s Q, and the Buffett Indicator (Mkt Cap / GDP) suggest that compound annual returns over the next decade are likely to be in the single digits.

Interest Rates

Rates rose in 2022 in response to a sharp pivot in monetary policy, but have mostly fallen (except for the very front end) so far in 2023. Futures markets are currently pricing a Fed pause after 500bp of hikes over the past 14 months, with the possibility of rate cuts in the back half of the year.

Inflation

After reaching 40yr highs in spring of 2022, inflation moderated in the second half of the year. Goods inflation has fallen due to softening demand and excess inventory, while services inflation remains elevated, in part due to shelter costs which are somewhat lagged.