Weekly Recap:

Better-than-expected inflation data drove rates lower across most of the curve last week, which in turn facilitated P/E multiple expansion and sent stocks higher.

The party got started in earnest on Tuesday, when core and headline CPI both came in below expectations for the month of June. Closely watched core CPI was just +0.2% m/m and fell to +4.8% y/y, while headline CPI also printed at +0.2% m/m and dropped to +3.0% y/y thanks to much lower energy prices relative to this time last year. See the Chart of the Week for a time series of the y/y change in core and headline CPI.

Further upstream, PPI printed at +0.1% m/m across the board (headline, core, and ex trade), with headline PPI nearly entering outright deflation territory for the first time since 2020 at just +0.1% on a y/y basis as well.

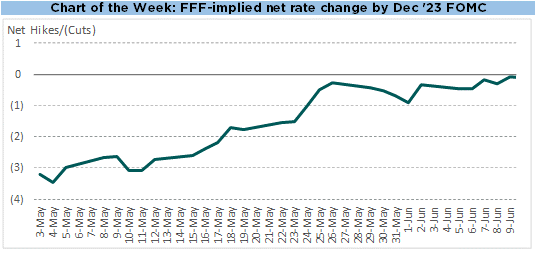

The inflation news sent rates lower across the curve, and the likelihood of a second additional rate hike before year-end flipped from odds-on to odds-off (a single 25bp hike at the July meeting appears all but assured at this point).

P/E multiples flexed up on falling discount rates, pushing most US equity benchmarks higher by 2-3% with duration-sensitive growth sectors outperforming. International stocks also outperformed, but continue to lag the US on a YTD basis.

Albion’s “Four Pillars”:

Economy & Earnings

The US economy showed resilience in the first half of 2023, and Wall Street analysts expect full-year corporate earnings to be roughly flat y/y. Albion’s base case expectation is that the US economy will enter recession in the second half of 2023, putting downside pressure on earnings.

Valuation

The S&P 500’s forward P/E of 19x is above the long run average, so valuation could be a headwind to future returns. More predictive metrics like CAPE, Tobin’s Q, and the Buffett Indicator (Mkt Cap / GDP) suggest that compound annual returns over the next decade are likely to be in the mid single digits.

Interest Rates

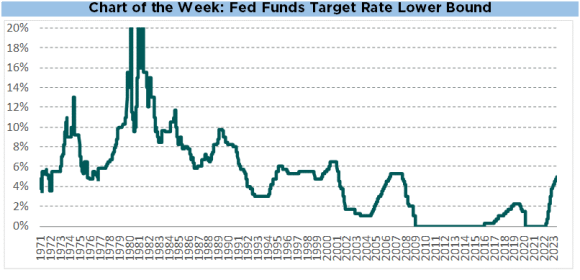

Rates rose dramatically in 2022 due to a sharp pivot in monetary policy, and have remained elevated in 2023 as progress on inflation has been slower than hoped. Futures markets are currently pricing 1-2 additional 25bp rate hikes over the summer, with no rate cuts expected before year-end.

Inflation

After reaching 40yr highs in spring of 2022, inflation has moderated somewhat over the past 12 months. Goods inflation has fallen due to softening demand and excess inventory, while services inflation remains elevated, in part due to shelter costs which are somewhat lagged.